All-in-one Event Management Software for

In-Person, Hybrid, and Virtual Events

All-in-one Event Management Software for

In-Person, Hybrid, and Virtual Events

Award-Winning Event App

Affordable Event Registration

Time-saving Event Management

Powerful Event Marketing

Trusted by Distinguished Innovators

Corporate Events

Academic Events

Government Events

Association Events

Conferences

Trade Shows

Festivals

& Art Shows

Make Your Attendees 10 Times Happier

Provide the best experience to your attendees with the award-winning event app! Enable them to participate and interact more actively, and build two times more connections. Up-to-date event information, personalized agenda, live polls, messages, and exciting photos are all at their fingertips.

L’Oreal

Save 60% More Time Managing Event Logistics

Complete tedious event management tasks with a few clicks and focus on more important things! Save your time with our popular event management software that includes an agenda center, speaker hub, name badge generation, check-in, announcements, and more.

European Bank for Reconstruction and Development

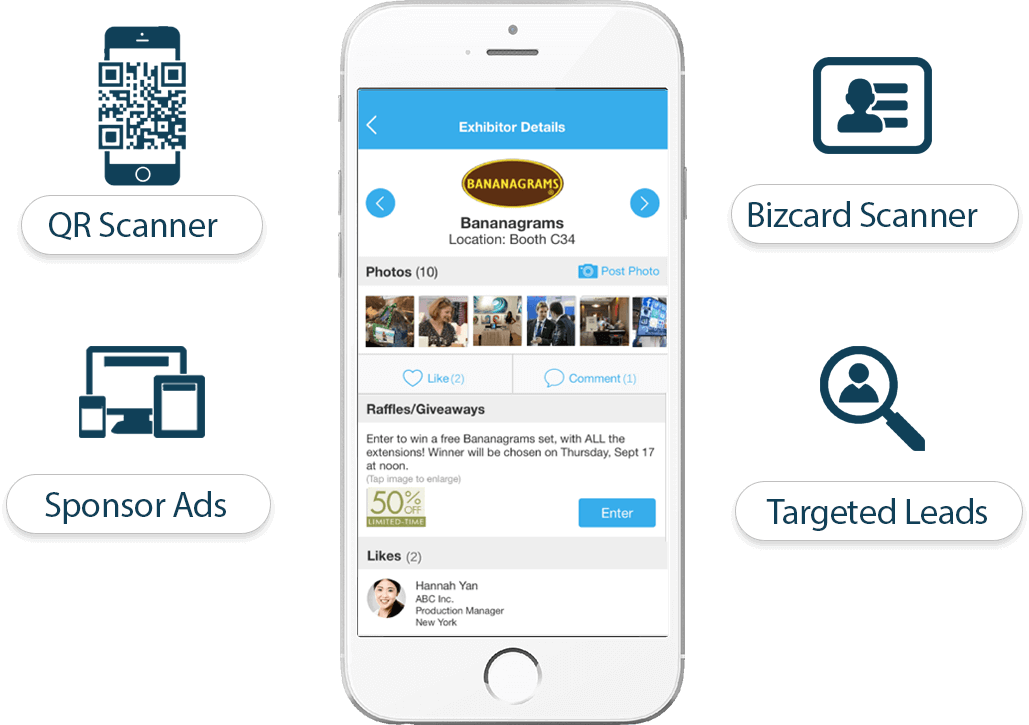

Delight Sponsors and Exhibitors with Great ROI

Showcase your sponsors and exhibitors with various opportunities embedded into Whova’s event app and live slideshow. Equip them with powerful lead generation tools such as business card scanning, promotional opportunities, QR code scanning, and much more.

FeedBlitz

The Most-Loved Event App

Top-Notch Customer Support

|

Quick Responses |

|

|

Weekends and Holidays |

|

|

A Dedicated Team |

Lake Yale Baptist Conference Center

In the News

What is Unique about Whova Event Management?

Make your Event Look

Modern and Trendy

Impress your attendees, sponsors, and management team with cutting-edge technology.

Engage Attendees

Effectively

Inspire attendee loyalty by creating immersive event experiences easily and effectively

Save Time Managing

Event Logistics

Complete tedious event management tasks with a few clicks and focus on more important things!

Ready to Get Started?

It is easy to get your event set up!

Let's Work Together

We’ll find a price that fits your budget.

Let's Work Together

We’ll find a price that fits your budget.